mississippi income tax forms

Department of Revenue - State Tax Forms. Accessibility Covid Resources ACE Login Search.

Mississippi Residential Lease Agreement Form Lease Agreement Free Printable Lease Agreement Lease

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. If you are receiving a refund. Most states will release updated tax forms between January and April. This form is for income earned in tax year 2021 with tax returns due in April 2022.

23 Total Mississippi income tax due line 20 plus line 21 and line 22 24 Mississippi income tax withheld complete Form 80-107 25 Estimated tax payments extension payments andor amount paid on original return. Corporate Income and Franchise Tax Return. Corporate Franchise Tax Schedule.

Net Operating Loss Capital Gains Schedule. The Department of Revenue is responsible for titling. 42 Interest income from Form 80-108 part II line 3 43 Dividend income from Form 80-108 part II line 6 39 Capital gain.

Department of Revenue - State Tax Forms. TaxFormFinder has an additional 36 Mississippi income tax forms that you may need plus all federal income tax forms. Vital Records Request.

These 2021 forms and more are available. Form 80-205 is a Mississippi Individual Income Tax form. To comply with the Military Spouse Residency Relief Act PL111-97 signed into law.

Box 22781 Jackson MS 39225-2781. E-FIle Directly to Mississippi for only 1499. Taxpayer Access Point TAP.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Mississippi. Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return. Mississippi Form 80-160 Other State Tax Credit.

A downloadable PDF list of all available Individual Income Tax Forms. The TaxSlayer Pro desktop program supports the following Mississippi Business forms. Renew Your Driver License.

These back taxes forms can not longer be e-Filed. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Locate Your Tax Refund. You must file online or through the mail yearly by April 17. You must file online or through the mail yearly by April 17.

Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. You need to file form 80-300 with the Mississippi Department. Income and Withholding Tax Schedule 80107218pdf Form 80-107-21-8-1-000 Rev.

EMPLOYER INCOME TAX MUST BE WITHHELD BY THE EMPLOYER ON TOTAL 7. Ad e-File Free Directly to the IRS. All other income tax returns.

Form 80-105 is the general individual income tax form for Mississippi residents. A downloadable PDF list of all available Individual Income Tax Forms. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face.

The Mississippi income tax rate for tax year 2021 is progressive from a low of 0. Purchase Hunting Fishing License. Emergency Services Health Social Services New Residents Guide E11 Directory.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Mississippi Form 80-205 Nonresident and Part-Year Resident Return. 24 Mississippi income tax withheld complete Form 80-107 25 Estimated tax payments extension payments andor amount paid on original return.

You may file your Form 80-105 with paper forms through the mail or online with efiling. 38 Wages salaries tips etc. The current tax year is 2021 with tax returns due in April 2022.

Form 80-105 requires you to list multiple forms of income such as wages interest or alimony. Form 80-106 - Payment Voucher. Payment Voucher and Estimated Tax.

Many states have separate versions of their tax returns for nonresidents or part-year residents - that is people who earn taxable income in that state live in a different state or who live in the state for only a portion of the year. 819 MISSISSIPPI EMPLOYEES WITHHOLDING EXEMPTION CERTIFICATE Employees Name SSN Employees Residence Address Marital Status EMPLOYEE. Download the Employer Change Request form.

Other Mississippi Individual Income Tax Forms. Mississippi state income tax Form 80-105 must be postmarked by April 18 2022 in order to avoid penalties and late fees. You may also want to visit the Federal income tax forms page.

42 Interest income from Form 80-108 part II line 3 43 Dividend income from Form 80-108 part II line 6 39 Capital gain loss attach Federal Schedule D if applicable. Mississippi Form 80-105 Resident Return. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Access IRS Tax Forms. Complete Edit or Print Tax Forms Instantly.

Welcome to The Mississippi Department of Revenue. Below are forms for prior Tax Years starting with 2020. 19 rows Mississippi has a state income tax that ranges between 3 and 5 which is.

Ad File Your 1040ez Tax Form for Free. Mississippi Income Tax Forms. Form 80-105 is the general individual income tax form for Mississippi residents.

Complete Form 80-107 Mississippi Income ONLY 51 Payments to self-employed SEP SIMPLE and qualified retirement plans Total Income From All Sources 50 Payments to IRA 58 Self. 26 Mississippi income tax withheld complete Form 80-107 20 Income tax due from Schedule of Tax Computation see instructions. More about the Mississippi Form 80-108.

We last updated Mississippi Form 80-108 in January 2022 from the Mississippi Department of Revenue. Mississippi Department of Employment Security Tax Department PO. This website provides information about the various taxes administered access to online filing and forms.

These nonresident returns allow taxpayers to specify. Once you have completed the form you may either e-mail it as an attachment to candsmdesmsgov or fax it to 601-321-6173 or print it out and mail it to. Form 80-105 is the general individual income tax form for Mississippi residents.

Net Taxable Income Schedule. You must file online or through the mail yearly by April 17. Individual Income Tax.

0621 Mississippi Income Withholding Tax Schedule 2021 801072181000 Reset Form Print Form Primary Taxpayer Name as shown on Forms 80-105 80-205 and 81-110 THIS FORM MUST BE FILED EVEN IF YOU HAVE NO MISSISSIPPI WITHHOLDING A - Statement Information B -. Form Code Form Name. Details on how to only prepare and print a Mississippi 2021 Tax Return.

Mississippi Form 80-108 Adjustments and Contributions.

Iowa Do Not Resuscitate Form Templates Iowa Legal Forms

Individual Income Tax Forms Dor

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Printable Sample It Services Contract Form Contract Template Cleaning Contracts Pest Control

File Accurate Income Tax Returns In The Safest Way Possible Via E File Opt For Direct Deposit As The Quickest Method T Income Tax Tax Return Income Tax Return

Form 656 Ppv Offer In Compromise Periodic Payment Voucher Offer In Compromise Tax Debt Debt Problem

Income Form Pdf Fill And Sign Printable Template Online Us Legal Forms

Here S How To Track Your Stimulus Check From The Irs Irs Irs Taxes How To Find Out

Maine Tax Forms And Instructions For 2021 Form 1040me

Tax Form Templates 5 Free Examples Fill Customize Download

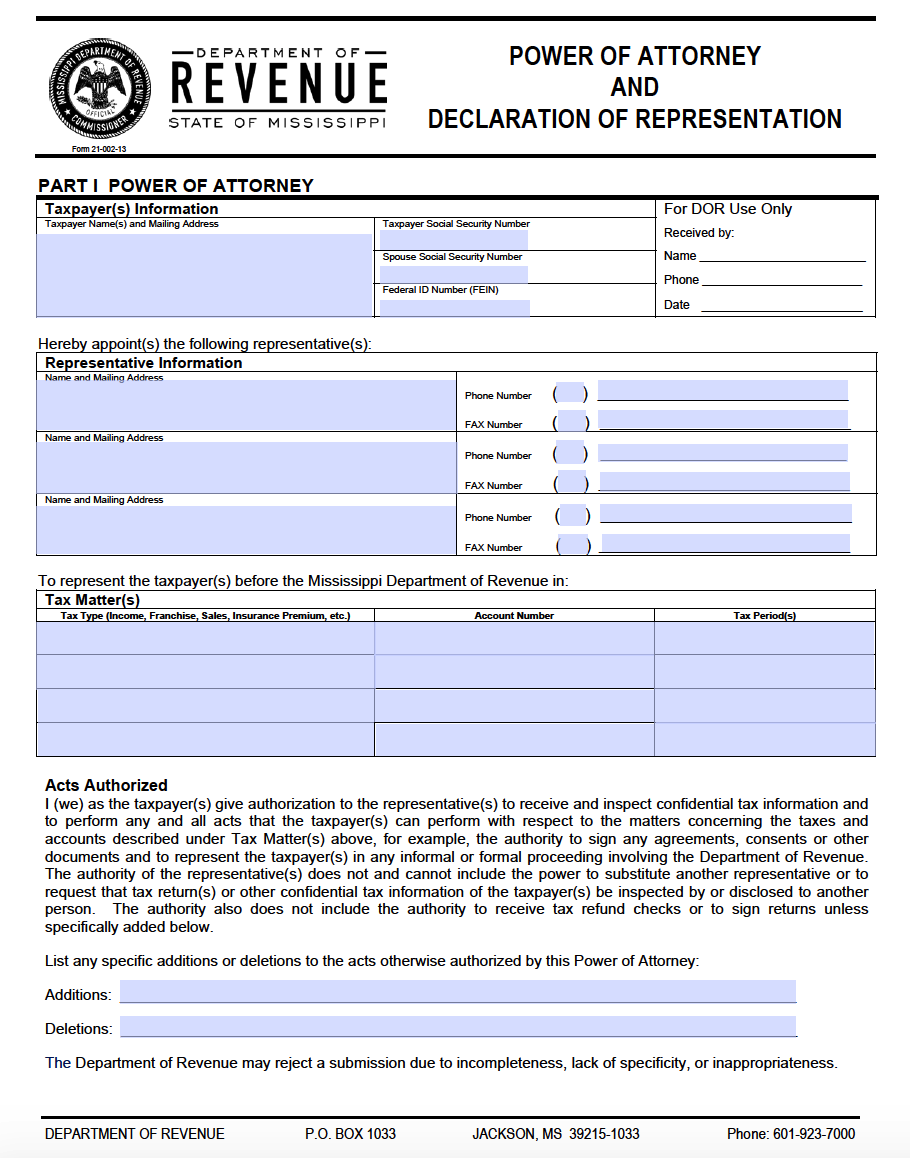

Free Tax Power Of Attorney Mississippi Form Adobe Pdf

How To File Taxes For Free In 2022 Money

Hipaa Confidentiality Agreement Template Free Pdf Word Doc Apple Mac Pages Google Docs Communication Plan Template Contract Template Company Financials

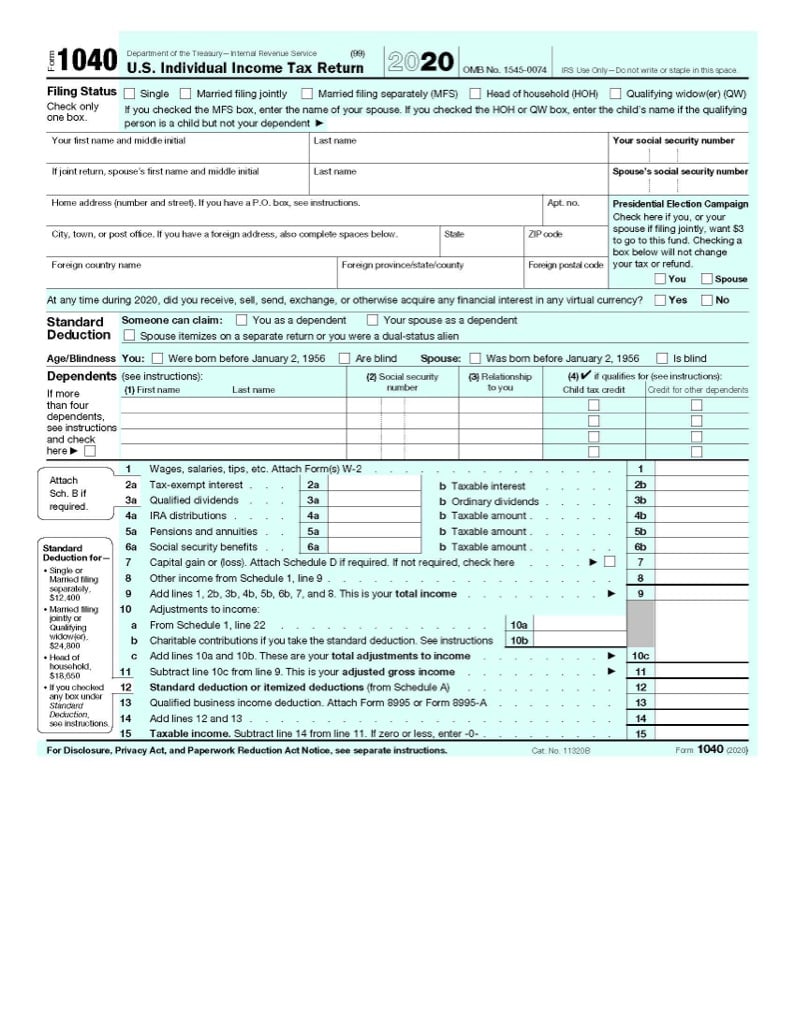

Form 1040a Irs Tax Forms Jackson Hewitt

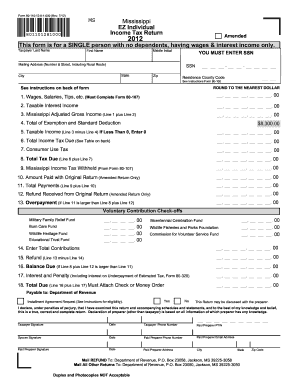

Mississippi State Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller

11 Divorce Certificate Templates Free Printable Word Pdf Certificate Templates Divorce Papers Fake Divorce Papers